Your Property tax penalty waiver letter sample images are available in this site. Property tax penalty waiver letter sample are a topic that is being searched for and liked by netizens today. You can Find and Download the Property tax penalty waiver letter sample files here. Get all royalty-free photos and vectors.

If you’re searching for property tax penalty waiver letter sample images information related to the property tax penalty waiver letter sample topic, you have come to the right site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

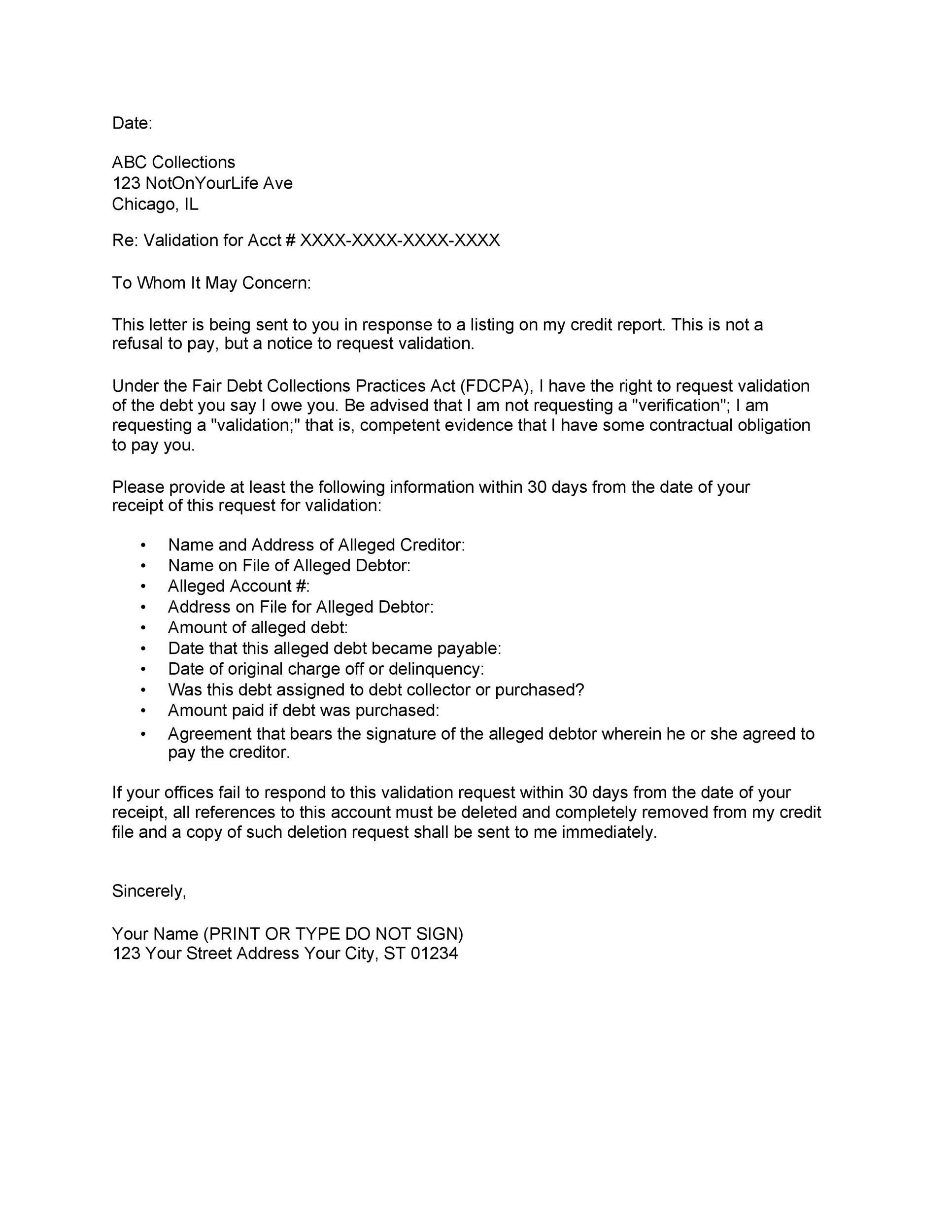

Property Tax Penalty Waiver Letter Sample. Ad Avoid Errors In Your Liability Waiver. California Revenue Taxation Code. This is a Letter to the Tax Office Inland Revenue Department requesting to waive the late filing payment penalty because of various reasons including relying on an unreliable professional firm. B The following factors shall be considered in determining if waiver of a fee or penalty facil-itates collection of the tax liability.

Explore Our Example Of First B Notice Form Template Letter Templates Letter Writing Template Lettering From pinterest.com

Explore Our Example Of First B Notice Form Template Letter Templates Letter Writing Template Lettering From pinterest.com

Petition for Waiver page 2 of 2 150-303-066 05-08 3082957 Penalties for failure to file real property or com-bined return on time. 21 hours agoPenalty may be waived on an assessment if you can show reasonable cause for be submitted to substantiate the reason for your penalty waiver request. Edit Save Print A Waiver Of Liability - Simple Builder - Try 100 Free. More from HR Block. Complete Edit or Print Tax Forms Instantly. Here is a sample waiver letter for waiving personal rights.

Dischargeability of tax liability in bankruptcy.

Please enter information for each bill for which you are requesting a waiver. Penalty Abatement Coordinator address provided on notice of tax amount due indicate what tax form it is pertaining to eg. Apr 17 2019 9 Tax Penalty Waiver Letter Sample There are plenty of resources on the internet for sample letters. If you wish to submit more than 4 bills you will be required to submit another request. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Over 1M Forms Created - Try 100 Free.

Source: pinterest.com

Source: pinterest.com

Complete Edit or Print Tax Forms Instantly. Over 1M Forms Created - Try 100 Free. A letter requesting waiver of personal rights should mention the dangers involved in signing the letter. Request for Penalty Abatement Under FTA Administrative Waiver taxpayer names address SSN or TIN Date To Whom it May Concern. Complete Edit or Print Tax Forms Instantly.

Source: pinterest.com

Source: pinterest.com

Start of Letter Internal Revenue Service Penalty Abatement Coordinator address provided on notice of tax amount due indicate what tax form it is pertaining to eg. Sample Letter Abatement for More Than One Year After Getting Letter. An IRS Penalty Response letter is a document used to file a request with the IRS that a penalty levied against a taxpayer either an individual or a business be reduced or canceled. Complete Edit or Print Tax Forms Instantly. This letter is the same type as a letter requesting a person to waive his or her personal rights.

Source: pinterest.com

Source: pinterest.com

Apr 17 2019 9 Tax Penalty Waiver Letter Sample There are plenty of resources on the internet for sample letters. Attach documentation that supports the basis of your request to cancel your tax penalty. This is a Letter to the Tax Office Inland Revenue Department requesting to waive the late filing payment penalty because of various reasons including relying on an unreliable professional firm. Wilderness properties Inc. If the IRS rejects your penalty waiver application a tax relief professional can persuade the IRS to amend their position.

Source: pinterest.com

Source: pinterest.com

More from HR Block. 21 hours agoPenalty may be waived on an assessment if you can show reasonable cause for be submitted to substantiate the reason for your penalty waiver request. If you wish to submit more than 4 bills you will be required to submit another request. San Diego CA 92120. Sample Letter Abatement for More Than One Year After Getting Letter.

Source: pinterest.com

Source: pinterest.com

Riverside CA 92502-2205. This should make the situation clear so the signee knows exactly what is involved. An IRS Penalty Response letter is a document used to file a request with the IRS that a penalty levied against a taxpayer either an individual or a business be reduced or canceled. If the IRS rejects your penalty waiver application a tax relief professional can persuade the IRS to amend their position. Start of Letter Internal Revenue Service Penalty Abatement Coordinator address provided on notice of tax amount due indicate what tax form it is pertaining to eg.

Source: pinterest.com

Source: pinterest.com

Riverside CA 92502-2205. More from HR Block. Wilderness properties Inc. Complete Edit or Print Tax Forms Instantly. Collectability of the tax penalty and interest directly from the taxpayer as determined from the taxpayers financial statements.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title property tax penalty waiver letter sample by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.