Your Hmrc tax notification letter images are available in this site. Hmrc tax notification letter are a topic that is being searched for and liked by netizens now. You can Get the Hmrc tax notification letter files here. Download all free images.

If you’re looking for hmrc tax notification letter images information connected with to the hmrc tax notification letter topic, you have pay a visit to the right site. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Hmrc Tax Notification Letter. These notices sent in the form of a letter are warning signs that HMRC has now escalated your situation to the point where they are going to enforce bailiff action. Your tax-free amount reduced or increased as necessary is turned into a tax code. The refund related to deductions that HMRC had continued to make for child benefit even though he became free of the tax charge a few months into the 2020-21 tax year. Letter before applying for Tribunal approval.

HM Revenue Customs Inland Revenue tax document eg. This represents the 12500 of tax-free income you can earn in this tax year. Original notification letter from the relevant benefits agency confirming the right to benefits or state pension. - PAYE Coding Notice. Using information gathered from banks and peer-to-peer lenders the Connect system clearly has a processing power far superior to any human team. Dear HM Revenue and Customs I have been asked by the bank to provide an HMRC tax notification letter because I get wages paid in cash.

His tax code notice.

HMRC CLIENT NOTIFICATION LETTER YOU MAY NEED TO SEND. Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for. HMRC Freedom of Information Team Please do not respond to this email as emails which do not relate to requests under the FOIA will not be actioned. Ive looked for more info online but had no luck and everywhere is. Dear HM Revenue and Customs I have been asked by the bank to provide an HMRC tax notification letter because I get wages paid in cash. HM Revenue Customs needlessly Inspirationa Writing A Letter To Tax Office Tax free investment.

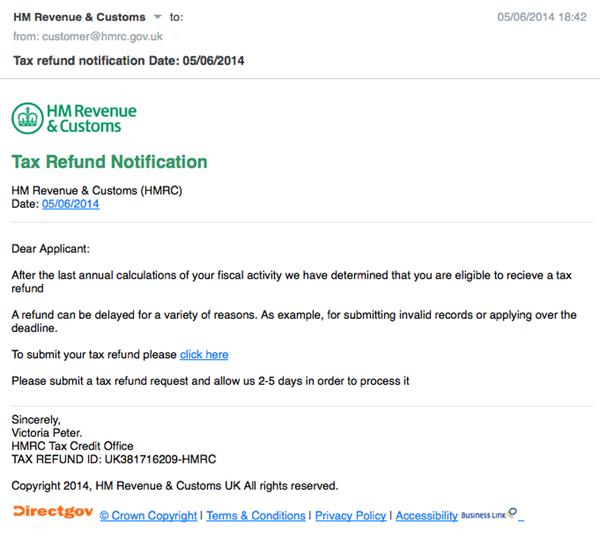

Source: grahamcluley.com

Source: grahamcluley.com

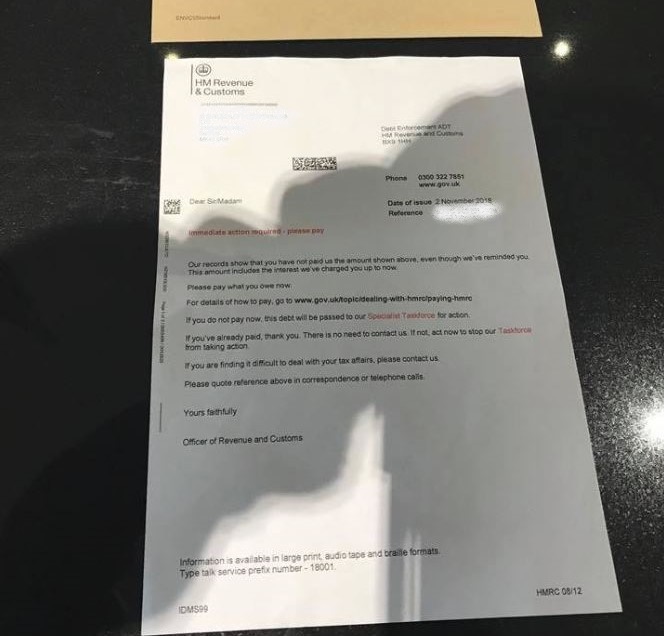

Using information gathered from banks and peer-to-peer lenders the Connect system clearly has a processing power far superior to any human team. Take note that this is payable nine months and a day after your filing date so if your accounting period finishes on the 31st of March the payment is due on the 1st of January. These notices sent in the form of a letter are warning signs that HMRC has now escalated your situation to the point where they are going to enforce bailiff action. How to tell HMRC a new company is dormant HM Revenue Customs Refund of Overpayments Phishing Scam Self Assessment Tax Returns and payments inniAccounts Church and State Blog. - HMRC Notification of Childrens Tax Credit.

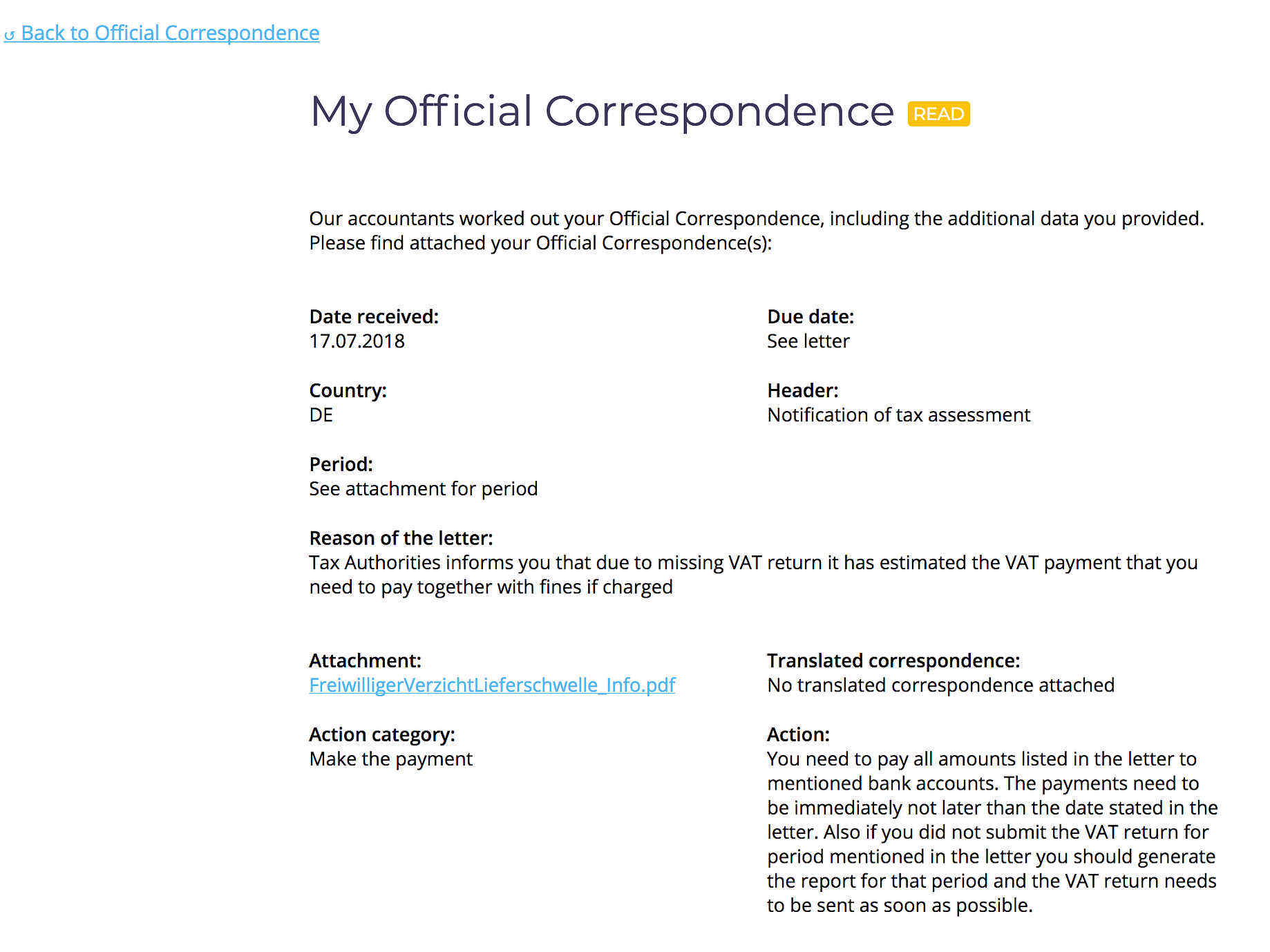

Source: inniaccounts.co.uk

Source: inniaccounts.co.uk

The refund related to deductions that HMRC had continued to make for child benefit even though he became free of the tax charge a few months into the 2020-21 tax year. Legislate to write a letter Advisers take note of. Letter before applying for Tribunal approval. JSL5150 The Notification Letter template. Although it looks like an official and authentic HMRC letter it is definitely a scam for the following reasons.

Source: litrg.org.uk

Source: litrg.org.uk

Or services for their personal tax This letter can be sent via post or email if this is the way your firm usually communicates with the client and you reasonably believe the client will read it. Although it looks like an official and authentic HMRC letter it is definitely a scam for the following reasons. The number refers to the personal allowance amount that applies to that tax year. Letter before applying for Tribunal approval. Original notification letter from the relevant benefits agency confirming the right to benefits or state pension.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

P45s and P60s are not acceptable. The refund related to deductions that HMRC had continued to make for child benefit even though he became free of the tax charge a few months into the 2020-21 tax year. SCAM HMRC LETTER WARNING. Another option I have is a HMRC tax notification dated within 12 months. Using information gathered from banks and peer-to-peer lenders the Connect system clearly has a processing power far superior to any human team.

Source: begbies-traynorgroup.com

Source: begbies-traynorgroup.com

Or services for their personal tax This letter can be sent via post or email if this is the way your firm usually communicates with the client and you reasonably believe the client will read it. Our customer support team will check your records and confirm that the letter is from HMRC. P45s and P60s are not acceptable. HMRC Freedom of Information Team Please do not respond to this email as emails which do not relate to requests under the FOIA will not be actioned. This means your companys goods will be seized and sold at auction so that HMRC can recoup some of the money owed to them.

It must contain your full name and current address. When the due date for your Corporation Tax bill is approaching you will receive this letter as a reminder to send in payment for it. Section 50 Finance Act no2 2015 International agreements to improve compliance. This means your companys goods will be seized and sold at auction so that HMRC can recoup some of the money owed to them. Tax notification letter cirilo correia made this Freedom of Information request to HM Revenue and Customs This request has been closed to new correspondence.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

- PAYE Coding Notice. HMRC-issued tax notification NB. What is a Notice of Enforcement. HMRC drop the last digit of the tax-free amount and then add on a letter. Is an HMRC Tax notification letter enough proof of address.

HM Revenue Customs needlessly Inspirationa Writing A Letter To Tax Office Tax free investment. Although it looks like an official and authentic HMRC letter it is definitely a scam for the following reasons. His tax code notice. Dear HM Revenue and Customs I have been asked by the bank to provide an HMRC tax notification letter because I get wages paid in cash. P45s and P60s are not acceptable.

These notices sent in the form of a letter are warning signs that HMRC has now escalated your situation to the point where they are going to enforce bailiff action. Dear HM Revenue and Customs I have been asked by the bank to provide an HMRC tax notification letter because I get wages paid in cash. - HMRC Notification of Childrens Tax Credit. Receiving A Corporation Tax Reminder Letter From HMRC. - PAYE Coding Notice.

Ive looked for more info online but had no luck and everywhere is. The number refers to the personal allowance amount that applies to that tax year. The letter gives you the opportunity to make representations as HMRC is legally required to. HMRC drop the last digit of the tax-free amount and then add on a letter. Our customer support team will check your records and confirm that the letter is from HMRC.

Source: informdirect.co.uk

Source: informdirect.co.uk

Help - HMRC tax notification letter. Pdf TAX NOTIFICATION LETTER HMRC PRINTABLE DOCX ZIP DOWNLOAD. I dont drive so no full licence and my passport is currently being renewed. Employer-issued documents such as P60s are not acceptable End of year tax deduction certificates. The letter gives you the opportunity to make representations as HMRC is legally required to.

Source: informdirect.co.uk

Source: informdirect.co.uk

Tax notification letter cirilo correia made this Freedom of Information request to HM Revenue and Customs This request has been closed to new correspondence. For the 2020-21 tax year most basic rate HMRC taxpayers will have 1250 as their tax code number. Receiving A Corporation Tax Reminder Letter From HMRC. Your tax-free amount reduced or increased as necessary is turned into a tax code. Take note that this is payable nine months and a day after your filing date so if your accounting period finishes on the 31st of March the payment is due on the 1st of January.

Source: litrg.org.uk

Source: litrg.org.uk

Another option I have is a HMRC tax notification dated within 12 months. It must contain your full name and current address. The letter gives you the opportunity to make representations as HMRC is legally required to. Although it looks like an official and authentic HMRC letter it is definitely a scam for the following reasons. General Selling on Amazon Questions.

For example in 202122 a taxpayer in England whose tax-free amount is just the personal allowance of 12570 will have a tax code of 1257L. The number refers to the personal allowance amount that applies to that tax year. Current council tax demand letter or statement. How to tell HMRC a new company is dormant HM Revenue Customs Refund of Overpayments Phishing Scam Self Assessment Tax Returns and payments inniAccounts Church and State Blog. This represents the 12500 of tax-free income you can earn in this tax year.

Source: boox.co.uk

Source: boox.co.uk

When the due date for your Corporation Tax bill is approaching you will receive this letter as a reminder to send in payment for it. Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for. - HMRC Notification of Working Family Tax Credit. How to tell HMRC a new company is dormant HM Revenue Customs Refund of Overpayments Phishing Scam Self Assessment Tax Returns and payments inniAccounts Church and State Blog. - PAYE Coding Notice.

Take note that this is payable nine months and a day after your filing date so if your accounting period finishes on the 31st of March the payment is due on the 1st of January. Ive looked for more info online but had no luck and everywhere is. HM Revenue Customs Inland Revenue tax document eg. Legislate to write a letter Advisers take note of. HM Revenue Customs HMRC tax notification.

Source: medium.com

Source: medium.com

SCAM HMRC LETTER WARNING. Tax notification letter cirilo correia made this Freedom of Information request to HM Revenue and Customs This request has been closed to new correspondence. Tax assessment statement of account notice of coding. HM Revenue Customs Inland Revenue tax document eg. - HMRC Notification of Working Family Tax Credit.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

HM Revenue Customs HMRC tax notification. In 2017 for example HMRC sent out over 10000 letters to people who had submitted their 2014 to 15 tax return without fully declaring their savings interest. Receiving A Corporation Tax Reminder Letter From HMRC. Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for. Using information gathered from banks and peer-to-peer lenders the Connect system clearly has a processing power far superior to any human team.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc tax notification letter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.