Your Form 8300 letter to customer images are available. Form 8300 letter to customer are a topic that is being searched for and liked by netizens now. You can Find and Download the Form 8300 letter to customer files here. Download all royalty-free photos.

If you’re searching for form 8300 letter to customer pictures information connected with to the form 8300 letter to customer keyword, you have come to the right site. Our website always gives you hints for seeking the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Form 8300 Letter To Customer. 6050I and to notify customers identified in those transactions that we have filed the required report Pursuant to this requirement this letter serves as notification that Name of Dealership filed Form 8300 with the IRS on Date indicating that you gave us Amount in cash or cash. IRS Form 8300 Letter to Payer Created 42116. Dealers must notify customers of Form 8300 filing by Jan. You must notify every customer for whom youve filed an 8300 form in writing by January 31 st of the following year.

Enter all required information in the necessary fillable areas. Consult your judgecourt administrator regarding appropriate wording for the Form 8300 Customer Notification Letter your court will issue. Ad Download or Email IRS 8300 More Fillable Forms Register and Subscribe Now. The customer must be notified of the name and address of the person completing the Form 8300 the aggregate amount of reportable cash in all related cash transactions and that the information contained in the Form 8300 is being reported to the IRS. Voluntary use of Form 8300. Click Here for a sample letter that the dealership can use to notify the customer of the Form 8300 reporting.

IRS Form 8300 Letter to Payer Created 42116.

Because of strict tax return information confidentiality and disclosure rules. IRS Form 8300 Letter to Payer Created 42116. Failure to send written notice to customers as specified above can result in civil penalties ranging from 250 to 500 per customer. Get the free form 8300 letter to customer Description of form 8300 letter to customer Pursuant to this requirement this letter serves as notification that Name of Court filed Form 8300 with the IRS on Date indicating that you gave us Amount in cash or cash equivalents in connection with your payment of cash bail for case number. Merely informing the customer at the time of the sale that you will be filing the Form 8300 is not sufficient. If the dealer fails to obtain a social security number the Form 8300 should still be filed with.

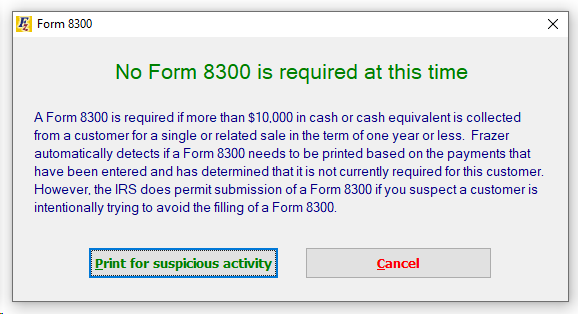

Pursuant to this requirement this letter serves as notification that Name of Dealership filed Form 8300 with the IRS on Date indicating that you gave us Amount in cash or cash equivalents in connection with your purchase of _____. On January 10 a customer makes a cash payment of 11000 to a business. Consult your judgecourt administrator regarding appropriate wording for the Form 8300 Customer Notification Letter your court will issue. IRS Form 8300 Year-End Customer Notification Letters With the 2017 year-end upon us this is an extremely busy time for the accounting staff in most dealerships. Form 8300 may be filed voluntarily for any suspicious transaction see Definitions later for use by FinCEN and the IRS even if the total amount does not exceed 10000.

IRS Form 8300 Year-End Customer Notification Letters With the 2017 year-end upon us this is an extremely busy time for the accounting staff in most dealerships. The IRS requires any person who receives more than 10000 in cash in a single transaction or a series of related transactions in 2020 while conducting his or her trade to file a Form 8300 with the agency. The IRS recommends that businesses keep a copy of every Form 8300 it files and the required statement. Voluntary use of Form 8300. Failure to send written notice to customers as specified above can result in civil penalties ranging from 250 to 500 per customer.

Source: pinterest.com

Source: pinterest.com

The same customer makes additional payments on the same transaction. Each time the payments aggregate in excess of 10000 the business must file another form 8300 within 15 days of the payment that causes the additional payments to total more than 10000. Adhere to our simple steps to have your Form 8300 Letter To Customer well prepared quickly. Must a business notify its customer that it has filed a Form 8300. Sincerely Your Name Your Title Your Business Address Your Business Phone Number.

Source: frazerhelp.com

Source: frazerhelp.com

If a business must file Form 8300 and the same customer makes additional payments within the 15 days before the business must file Form 8300 the business can report all the payments on one form. Currently persons engaged in a trade or business who receive more than 10000 in cash are required to report these transactions on Form 8300. Choose the web sample from the catalogue. Cash is not required to be reported if it is received. The same customer makes additional payments on the same transaction.

Source: pdffiller.com

Source: pdffiller.com

There are a number of important tasks that must be completed in conjunction with the year-end close. Businesses that deal in large cash transactions are required to report all of their dealings accurately and honestly with the IRS. If a business must file Form 8300 and the same customer makes additional payments within the 15 days before the business must file Form 8300 the business can report all the payments on one form. Checks and money orders or cash equivalents as defined by the IRS Form 8300 Reference Guide and to notify customers identified in those transactions that we have filed the required report. Choose the web sample from the catalogue.

Source: pinterest.com

Source: pinterest.com

This form is provided as a sample only and is not intended as legal advice. Get the free form 8300 letter to customer Description of form 8300 letter to customer Pursuant to this requirement this letter serves as notification that Name of Court filed Form 8300 with the IRS on Date indicating that you gave us Amount in cash or cash equivalents in connection with your payment of cash bail for case number. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The customer must be notified of the name and address of the person completing the Form 8300 the aggregate amount of reportable cash in all related cash transactions and that the information contained in the Form 8300 is being reported to the IRS. Dealers who receive more than 10000 in cash on a single transaction or related transactions must complete form 8300 Report of Cash Payments Over 10000 Received in a.

Source: irs.gov

Source: irs.gov

NOTICE TO CUSTOMERS. On January 10 a customer makes a cash payment of 11000 to a business. Check if everything is completed correctly without typos or absent blocks. Currently persons engaged in a trade or business who receive more than 10000 in cash are required to report these transactions on Form 8300. Professional Legal Solutions for All of Your Personal and Business Needs.

Source: pinterest.com

Source: pinterest.com

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Check if everything is completed correctly without typos or absent blocks. Failure to send written notice to customers as specified above can result in civil penalties ranging from 250 to 500 per customer. If you sent the customer the notice letter at the time of the transaction you do not need to send a notice at this time. IRS Form 8300 Year-End Customer Notification Letters With the 2017 year-end upon us this is an extremely busy time for the accounting staff in most dealerships.

Source: pinterest.com

Source: pinterest.com

The same customer makes additional payments on the same transaction. Adhere to our simple steps to have your Form 8300 Letter To Customer well prepared quickly. Cash Transaction Reporting Requirements. Businesses that deal in large cash transactions are required to report all of their dealings accurately and honestly with the IRS. Failure to send written notice to customers as specified above can result in civil penalties ranging from 250 to 500 per customer.

Source: pdffiller.com

Source: pdffiller.com

The same customer makes additional payments on the same transaction. Must a business notify its customer that it has filed a Form 8300. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Because of strict tax return information confidentiality and disclosure rules. Ad Trusted by Millions of Americans Like You.

Source: docformats.com

Source: docformats.com

Ad Trusted by Millions of Americans Like You. Checks and money orders or cash equivalents as defined by the IRS Form 8300 Reference Guide and to notify customers identified in those transactions that we have filed the required report. Professional Legal Solutions for All of Your Personal and Business Needs. Complete IRS Tax Forms Online or Print Government Tax Documents. NOTICE TO CUSTOMERS.

Source: docformats.com

Source: docformats.com

Dealers who receive more than 10000 in cash on a single transaction or related transactions must complete form 8300 Report of Cash Payments Over 10000 Received in a. Ad Trusted by Millions of Americans Like You. Form 8300 may be filed voluntarily for any suspicious transaction see Definitions later for use by FinCEN and the IRS even if the total amount does not exceed 10000. IRS Form 8300 Letter to Payer Created 42116. Failure to send written notice to customers as specified above can result in civil penalties ranging from 250 to 500 per customer.

Source: frazerhelp.com

Source: frazerhelp.com

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 1 PDF editor e-sign platform data collection form builder solution in a single app. 6050I and to notify customers identified in those transactions that we have filed the required report Pursuant to this requirement this letter serves as notification that Name of Dealership filed Form 8300 with the IRS on Date indicating that you gave us Amount in cash or cash. There are a number of important tasks that must be completed in conjunction with the year-end close. Dealers who receive more than 10000 in cash on a single transaction or related transactions must complete form 8300 Report of Cash Payments Over 10000 Received in a.

Source: in.pinterest.com

Source: in.pinterest.com

Sincerely Your Name Your Title Your Business Address Your Business Phone Number. Voluntary use of Form 8300. 1 PDF editor e-sign platform data collection form builder solution in a single app. Currently persons engaged in a trade or business who receive more than 10000 in cash are required to report these transactions on Form 8300. NOTICE TO CUSTOMERS.

Form 8300 may be filed voluntarily for any suspicious transaction see Definitions later for use by FinCEN and the IRS even if the total amount does not exceed 10000. The IRS requires any person who receives more than 10000 in cash in a single transaction or a series of related transactions in 2020 while conducting his or her trade to file a Form 8300 with the agency. 10000 in cash or cash equivalents as defined in 26 USC. BULLETIN 52021 January 13 2021 COMPLIANCE REMINDER - FORM 8300 TRANSACTIONS DEALERSHIP LETTERS DUE TO CUSTOMERS BY JANUARY 31 2021 Summary. Ad Trusted by Millions of Americans Like You.

Click here for a sample letter that the dealership can use to notify the customer of the Form 8300 reporting. If the dealer fails to obtain a social security number the Form 8300 should still be filed with. Currently persons engaged in a trade or business who receive more than 10000 in cash are required to report these transactions on Form 8300. One way the IRS makes sure that businesses stay honest is by requiring Form 8300. What is Form 8300.

Source: pinterest.com

Source: pinterest.com

You must notify every customer for whom youve filed an 8300 form in writing by January 31 st of the following year. BULLETIN 52021 January 13 2021 COMPLIANCE REMINDER - FORM 8300 TRANSACTIONS DEALERSHIP LETTERS DUE TO CUSTOMERS BY JANUARY 31 2021 Summary. IRS Form 8300 Letter to Payer Created 42116. 1 PDF editor e-sign platform data collection form builder solution in a single app. IRS Form 8300 Year-End Customer Notification Letters With the 2017 year-end upon us this is an extremely busy time for the accounting staff in most dealerships.

Source: pinterest.com

Source: pinterest.com

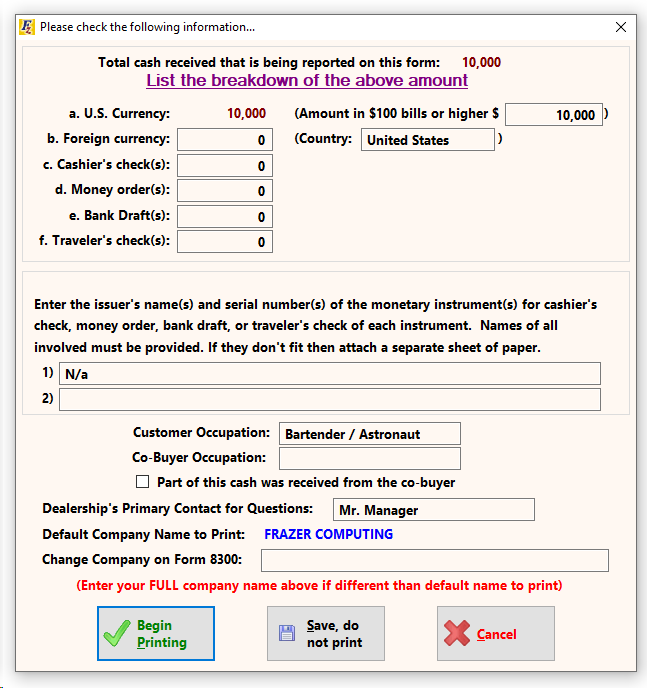

Must a business notify its customer that it has filed a Form 8300. The customer must be notified of the name and address of the person completing the Form 8300 the aggregate amount of reportable cash in all related cash transactions and that the information contained in the Form 8300 is being reported to the IRS. The same customer makes additional payments on the same transaction. Sincerely Your Name Your Title Your Business Address Your Business Phone Number. The Form 8300 Instructions a letter informing the customer that their information has been reported to the IRS and the Form 8300 will print.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title form 8300 letter to customer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.